massachusetts commercial real estate tax rates

Taxes might be in the commercial lease as a pass-through. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

How Much House Can I Afford Buying First Home First Home Buyer Real Estate Tips

The current tax rate is.

. A local option for cities or towns. Each year local assessors in every city and town in Massachusetts have a constitutional and statutory duty to assess all property at its full and fair cash. An owners property tax is based on the assessment which is the full and fair cash value of the property.

A quarterly real estate tax bill is mailed to every homeowner. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. The Tax Rate is set by the Select Board.

On the due date. MassTaxConnect Log in to file and pay taxes. In three communities the commercial rate.

Residential property tax rates in cities and towns around Massachusetts continued to decline this year as commercial rates edged upward indicating that more communities are shifting the burden of. Real Estate Residential 995. Tax amount varies by county.

Source MLSPIN April 6 2022 View All Towns View by County. Fiscal year 2018 tax rate 1465 per thousand. Real estate tax payments must be received in the tax collectors office by 400pm.

Open Save Print 2022_Property_Tax_Rates 2022 Rates Per 1000 assessed value. Legal requirements for commercial real estate transactions and contracts in Massachusetts. Many owners I speak with tell me that they dont want to sell their commercial real estate because of the tax liability.

The Bush Tax Cuts provided us with a 15 Federal capital gains rate which is one of the lowest rates since 1987. Contact Us Your one-stop connection to DOR. Who wants to sell a property and send 225 to the federal government.

Visit my blog to learn a bit more about real estate taxes. Tax bills reflect. Motor Vehicle Excise Tax.

Which Towns have the Highest Property Tax Rates in Massachusetts. The residential tax rate in Worcester is 1521. Town of Hanover 550 Hanover Street Hanover MA 02339 7818265000 Statement on Community Inclusiveness Website Disclaimer Hours.

Excise tax vehicles varies per. 23 hours agoThe newly proposed residential tax rate for the fiscal year that starts July 1 is 1780 per 1000 of home value lower than the 1850 rate proposed by Elorza in April. Property tax is an assessment on the ownership of real and personal property.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Property tax rates are also referred to as property mill rates. 372 rows The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value.

Massachusetts Property Tax Rates by Town. Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax. In Massachusetts commercial and residential tax rates are set at the city or town level and vary widely.

Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate info. This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and Rhode Island. This is followed by Wendell with the second highest property tax rate in Massachusetts with a property tax rate of 2324 followed by Greenfield with a property tax rate of 2232.

Issued July 1st Due 1st business day of August. Contractual nature of commercial real estate due to size of investments. Real Estate Commercial 2664.

Real Estate and Personal Property Tax. Datawrapper Residential tax rates decreased on average in Massachusetts for 2020. Sealer of Weights Measures.

Bostons residential tax rate is 1088 21 cents higher than last year. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. A Description of Commercial Transactions.

Residential Commercial Tax Rates Fiscal Year Residential Rate Commercial Rate Residential Exemption 2003 1129 3149 98815 2002 1101 3033 88114 2001 1058 3017 52452 2000 1315 3421 49912 1999 1344 3704 47469 1998 1347 3845 45313 1997 1373 4150 43589 1996 1378 4259 41811. Fiscal year 2021 tax rate 1465 per thousand. A commercial tenants furniture fixtures and equipment FFE can be taxed as personal property.

Zip Assessors Phone City Town Residential Commerc. A state sales tax. 2022 Berkshire County Massachusetts Property Tax Rates.

For the most up to date tax rates please visit the Commonwealth of Massachusetts. The median commercial tax rate increased in 2020. A state excise tax.

9 am4 pm Monday through Friday. The median residential tax rate for the 344 communities with. Most surrounding suburbs are between about 9 and 14.

An office building with a reception foyer wall paintings sculptures furniture can all be assessed and taxed as personal property. 104 of home value. Tax rates are set locally by cities and towns in massachusetts with total rates generally ranging from 1 to 2 10 to 20 mills.

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464. Shelby County will have a slightly lowered property tax rate for fiscal year 2023 after commissioners passed a rate of 339 per.

Tax bills are issued and due the same time every year. Bundle of Rights use enjoy control dispose as a way to understand the rights and obligations that are conveyed to others.

How To Start A Real Estate Business Infographic Here Are The 10 Steps To Starting A Real Esta Real Estate Infographic Business Infographic Real Estate Business

Applying Cost Segregation On A Tax Return The Wealthy Accountant How To Apply Tax Return Cost

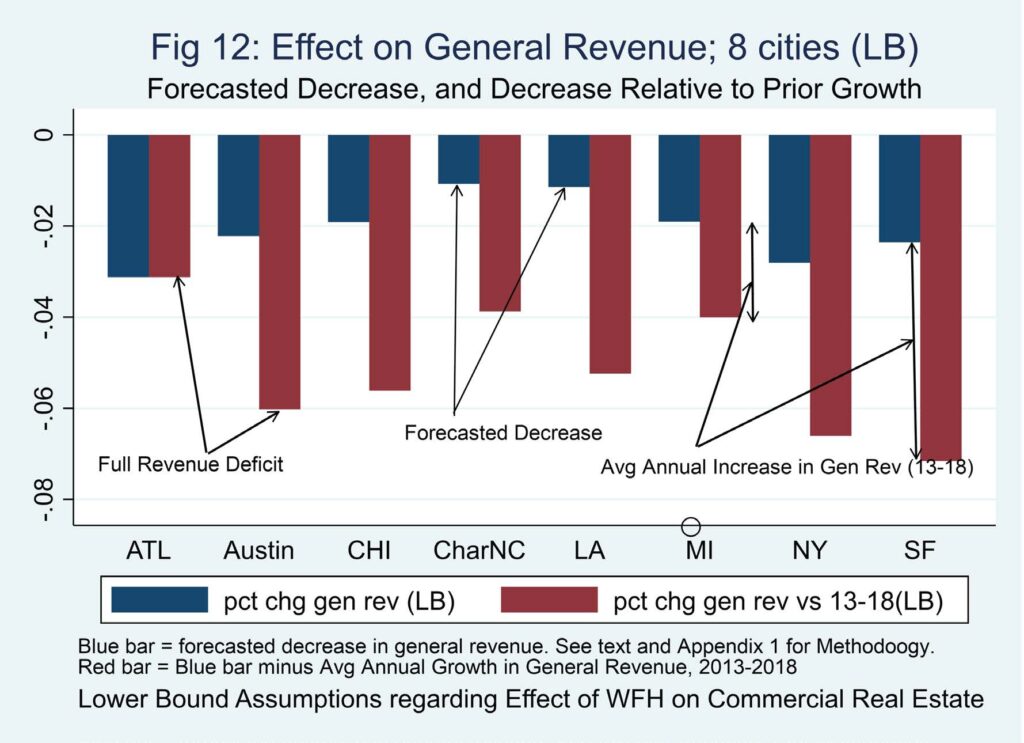

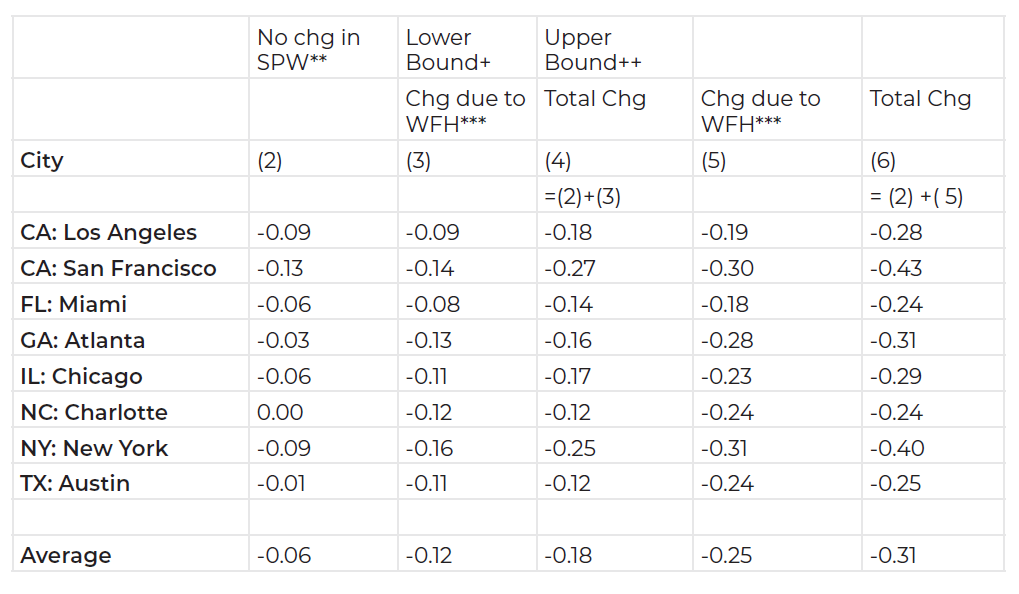

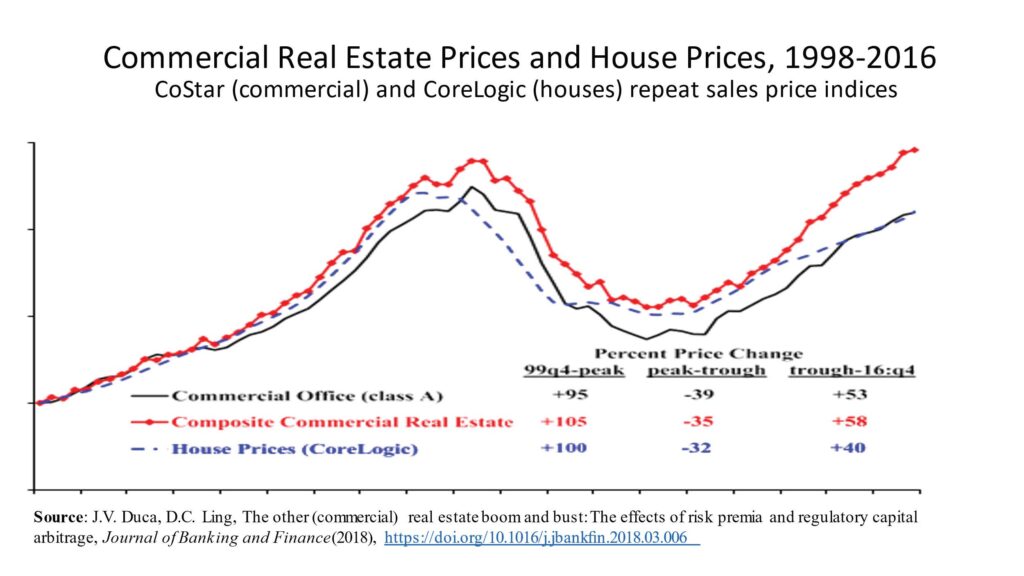

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Properties Commercial Real Estate Property Realty

The Official Site Of Town Of Northborough Ma Places New England Happy Places

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Wright S Dairy Farm Bakery Is One Of The Leading Fresh Local Bakeries Offering A Wide Range Of Breads And Pastries We Bakery Dairy Farms Bread And Pastries

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

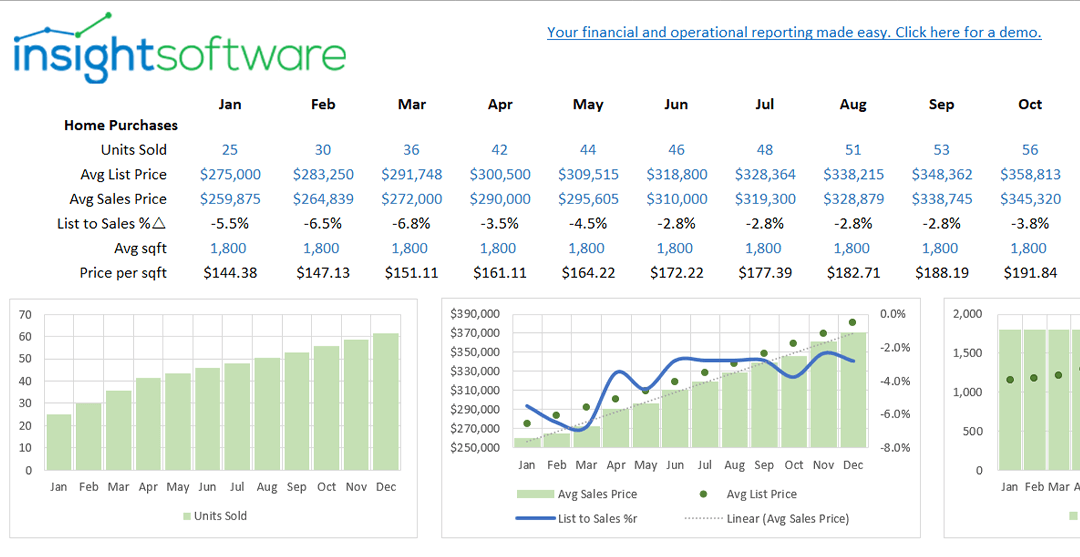

Top 22 Real Estate Kpis And Metrics For 2021 Reporting Insightsoftware

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Massachusetts Residential Lease Agreement Lease Agreement Landlord Lease Agreement Rental Agreement Templates

Sample Letter Of Explanation For Buying Second Home Elegant Real Estate Letters Of Introduction I Real Estate Tips Prospecting Real Estate Real Estate Investor

Easy Real Estate Commission Calculator Rentspree Blog

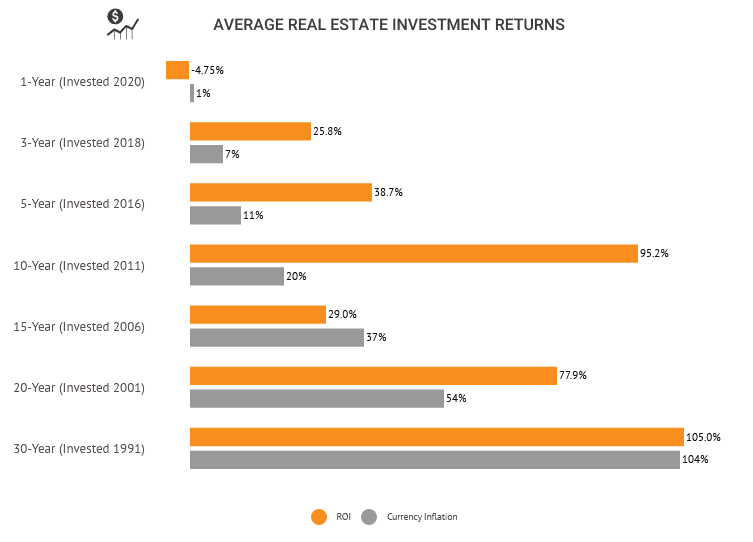

Average Roi Of Real Estate 2022 Historical Analysis Statistics

83 Shocking Real Estate Statistics You Need To Know The Close

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Real Estate Infographic Real Estate Postcards Investing